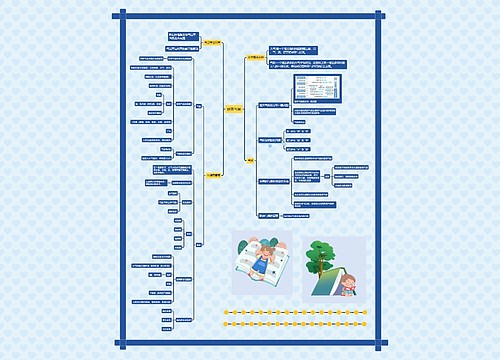

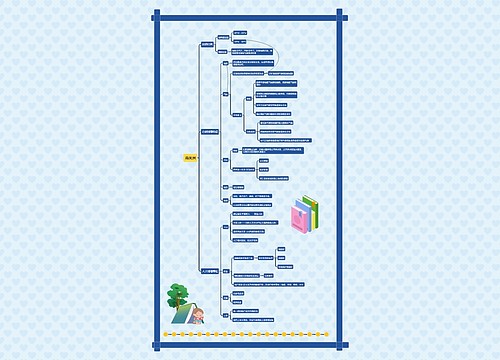

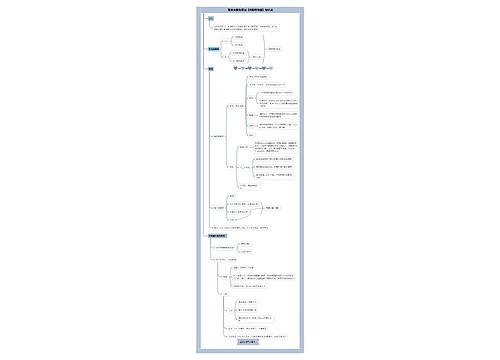

IFRS15 revenue思维导图

IFRS15 revenue内容详述

树图思维导图提供 IFRS15 revenue 在线思维导图免费制作,点击“编辑”按钮,可对 IFRS15 revenue 进行在线思维导图编辑,本思维导图属于思维导图模板主题,文件编号是:c95184e2b70d49b0fdfa5d4b713edbaf

思维导图大纲

IFRS15 revenue思维导图模板大纲

definition

normal trading

operating activities

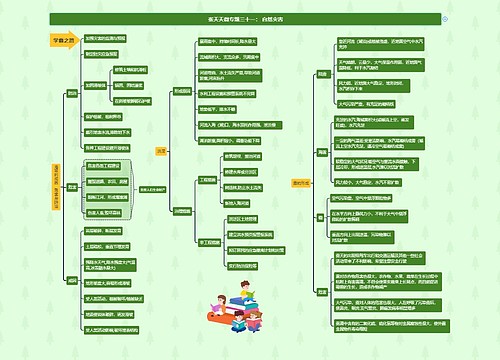

five step model

identify the contract with the customer

the parties have approved the contract

can identify each party's rights

can identify the payment terms

the contract has commercial substance

it is probable that entity will get the consideration

identify the separate performance obligations

can benefit from the good or service either on its own or together

warranites

when it can provide separate performance obligations

an entity is an agent , the revenue is recognised based on the fee or commission

whether have primarliy responsible

whether have inventory risk

can decision the products price

whether the consideration is commission

not have credit risk for the customer

determine the transaction price

variable consideration (highly probable )

it is highly probable that there will not be a reversal of revenue when any uncertainty associated with the variable consideration is resolved and should be use it best estimate .

For example : refunds , price concessions , credits and penalties

special : If the entity refund the consideration it should recognizes a refund liability

Non-cash consideration (fair value )

fair value

stand-alone selling price if fair value is not available

financing component (discount to present value )

difference between the amount of promised consideration and the cash selling price of the promised goods or services

length of time between the transfer of the promised goods or services to the customer and the payment date .

consideration payable to customer (in exchange for good or services )

If exchange back goods and services it just need calculate separate . If not exchange back goods and services it should be excluded from the considerations in averages .

allocate the transaction price to the performance obligations

total price shou;d be allocated to each performance obligation in proportion to stand-alone selling prices and if have dsicounts should be allcated across each component .

estimation techniques must be used if observable prices are not available (maxmizes obseravble inputs)

adjusted market assesssment approach

expected cost plus a margin approach

residual approach

recognize revenue when a performance obligations is satisfied

satisfied over time

simultaneously receives and consumes the benefits

performance creates or enhances an asset that the customer control

It is a specialize performance and the entity has an enforceable right to payment for the parts them completed

satisified at a point in time

control transfer

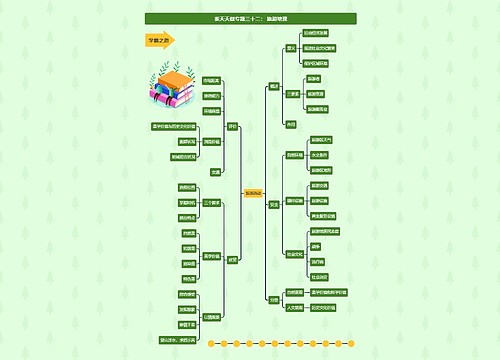

Contract revenue

revenue and cost

can measure with output methods or input methods

principle

If outcome is a profit ,revenue and costs should be recognized according to the progress of the contract .

If outcome is a loss ,the whole loss should be recognized immediately as s provision

if unknown revenue should be recognized to the level of recoverable costs .

special case of recognize

cosignment inventory

repurchase agreements

really sale : recognized

Not really : asset still in SOFP , recognized liability and interest

Bill-and -hold arrangements

control tranfers , whether providng custodial services (should be confirmed in separete obligations )

Non-refundable upfront fees

be recognised when future goods or services are provided

possible in exam

contract modifications

相关思维导图模板

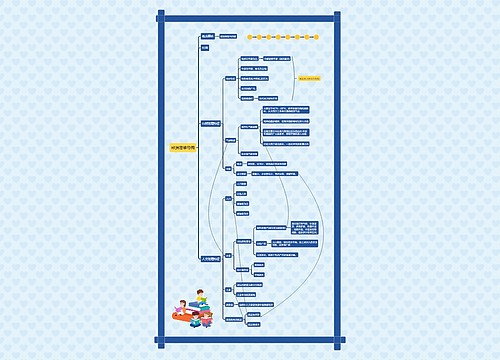

树图思维导图提供 金融机构合规文化建设 在线思维导图免费制作,点击“编辑”按钮,可对 金融机构合规文化建设 进行在线思维导图编辑,本思维导图属于思维导图模板主题,文件编号是:cbcfa0c1cf1c8ef09c1ce76f21486b9f

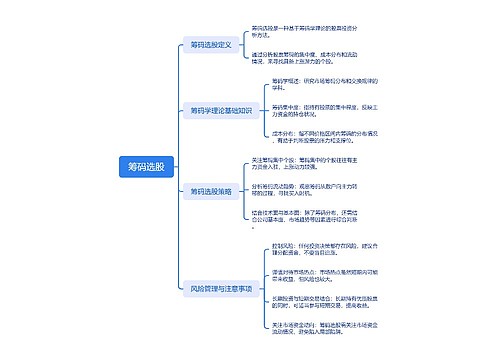

树图思维导图提供 筹码选股 在线思维导图免费制作,点击“编辑”按钮,可对 筹码选股 进行在线思维导图编辑,本思维导图属于思维导图模板主题,文件编号是:b808dde850c34abb704db98e614f66b5

上海工商

上海工商