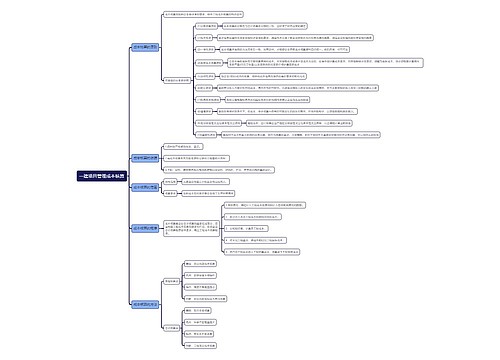

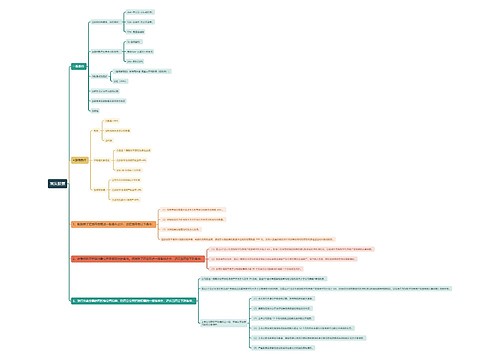

财管第二章思维导图

财务管理 公司财务 财务制度等内容讲解

树图思维导图提供 财管第二章 在线思维导图免费制作,点击“编辑”按钮,可对 财管第二章 进行在线思维导图编辑,本思维导图属于思维导图模板主题,文件编号是:140978ce25672f0897ba3f00fae94c65

思维导图大纲

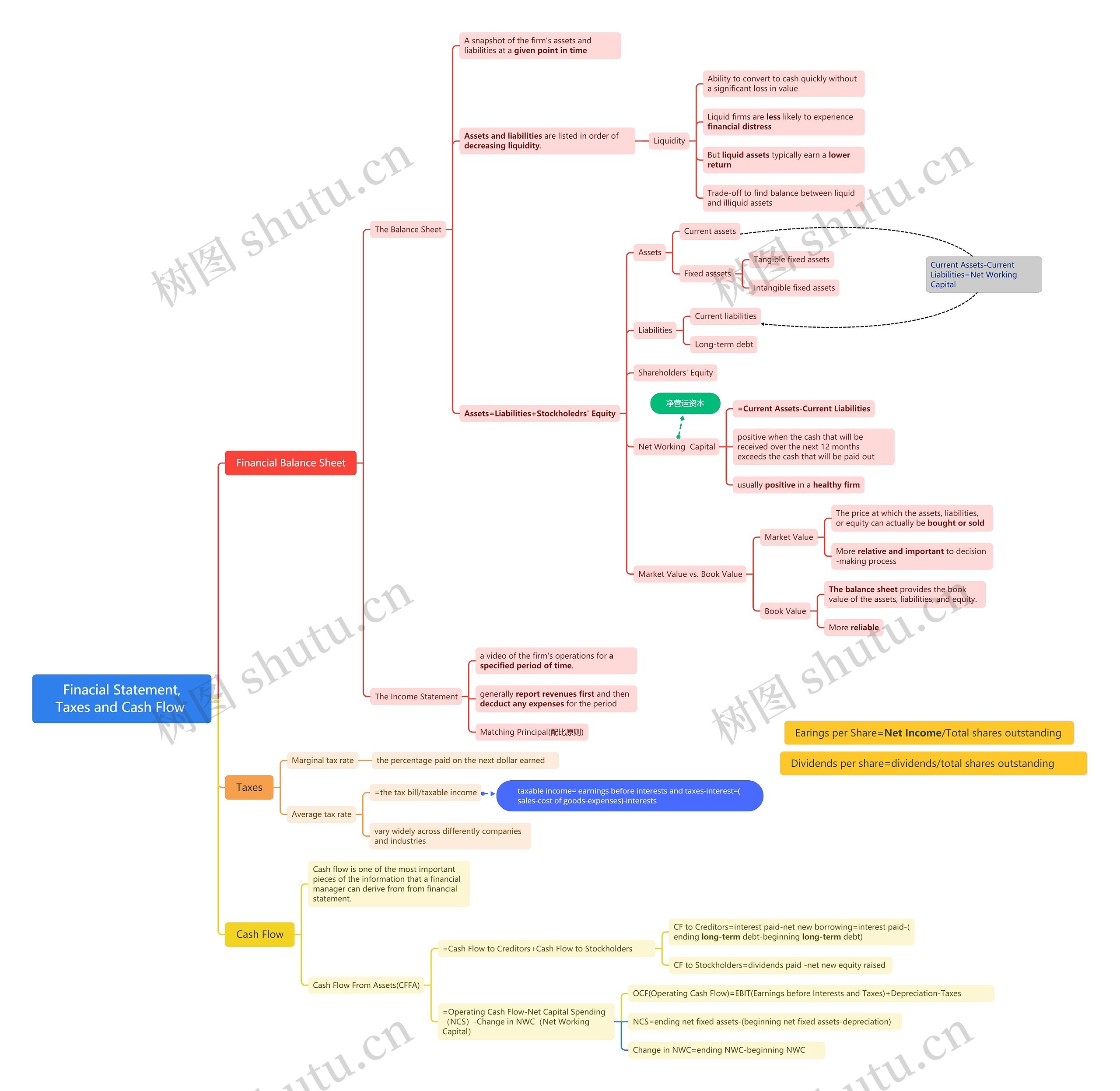

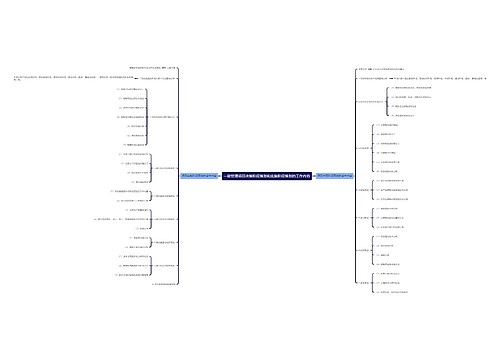

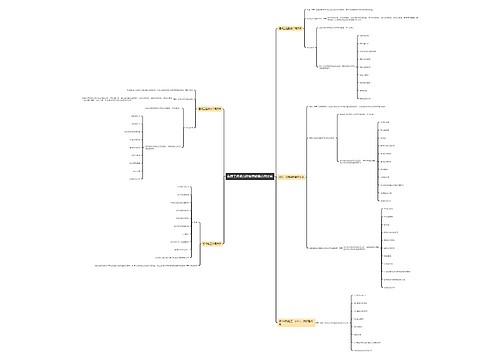

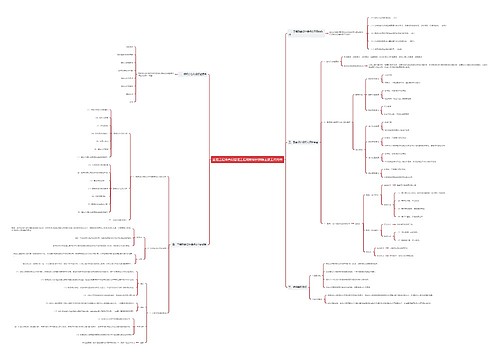

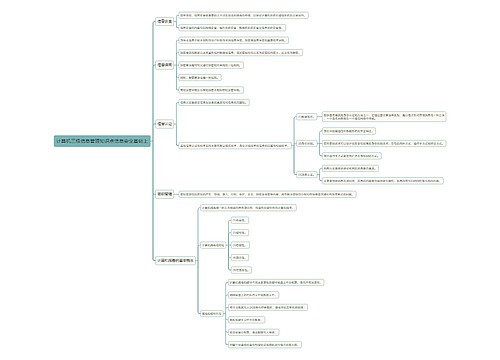

Finacial Statement,Taxes and Cash Flow 思维导图模板大纲

Financial Balance Sheet

The Balance Sheet

A snapshot of the firm's assets and liabilities at a given point in time

Assets and liabilities are listed in order of decreasing liquidity.

Liquidity

Ability to convert to cash quickly without a significant loss in value

Liquid firms are less likely to experience financial distress

But liquid assets typically earn a lower return

Trade-off to find balance between liquid and illiquid assets

Assets=Liabilities+Stockholedrs' Equity

Assets

Current assets

Fixed asssets

Tangible fixed assets

Intangible fixed assets

Liabilities

Current liabilities

Long-term debt

Shareholders' Equity

Net Working Capital

=Current Assets-Current Liabilities

positive when the cash that will be received over the next 12 months exceeds the cash that will be paid out

usually positive in a healthy firm

Market Value vs. Book Value

Market Value

The price at which the assets, liabilities, or equity can actually be bought or sold

More relative and important to decision-making process

Book Value

The balance sheet provides the book value of the assets, liabilities, and equity.

More reliable

The Income Statement

a video of the firm's operations for a specified period of time.

generally report revenues first and then decduct any expenses for the period

Matching Principal(配比原则)

Taxes

Marginal tax rate

the percentage paid on the next dollar earned

Average tax rate

=the tax bill/taxable income

vary widely across differently companies and industries

Cash Flow

Cash flow is one of the most important pieces of the information that a financial manager can derive from from financial statement.

Cash Flow From Assets(CFFA)

=Cash Flow to Creditors+Cash Flow to Stockholders

CF to Creditors=interest paid-net new borrowing=interest paid-(ending long-term debt-beginning long-term debt)

CF to Stockholders=dividends paid -net new equity raised

=Operating Cash Flow-Net Capital Spending(NCS)-Change in NWC(Net Working Capital)

OCF(Operating Cash Flow)=EBIT(Earnings before Interests and Taxes)+Depreciation-Taxes

NCS=ending net fixed assets-(beginning net fixed assets-depreciation)

Change in NWC=ending NWC-beginning NWC

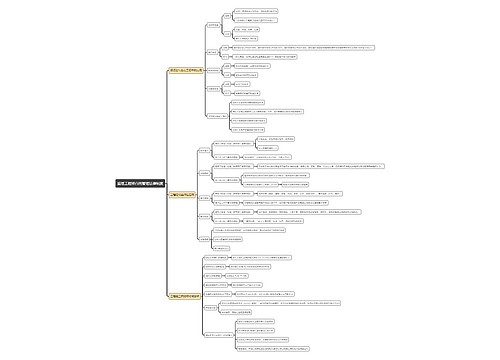

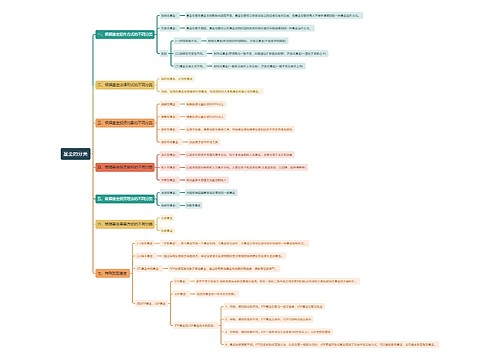

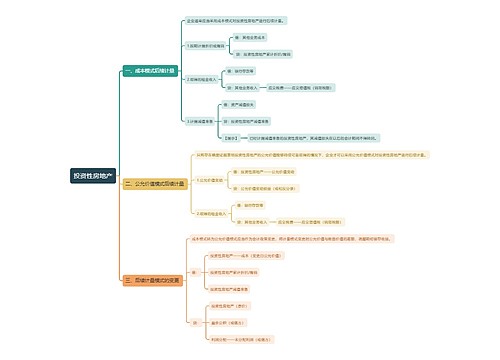

净营运资本思维导图模板大纲

taxable income= earnings before interests and taxes-interest=(sales-cost of goods-expenses)-interests思维导图模板大纲

Earings per Share=Net Income/Total shares outstanding思维导图模板大纲

Dividends per share=dividends/total shares outstanding思维导图模板大纲

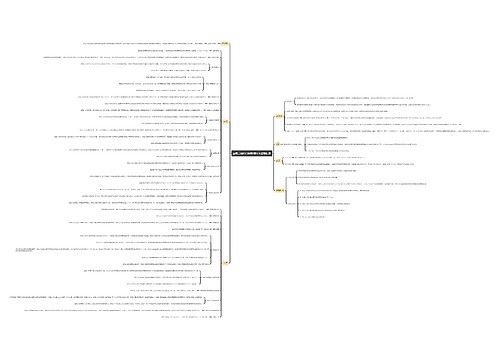

相关思维导图模板

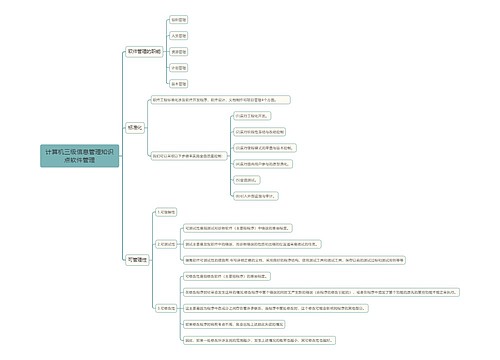

树图思维导图提供 数智技术在工程设备管理中的应用 在线思维导图免费制作,点击“编辑”按钮,可对 数智技术在工程设备管理中的应用 进行在线思维导图编辑,本思维导图属于思维导图模板主题,文件编号是:f9a2de84ad9a9ceebc96385d71be9ebe

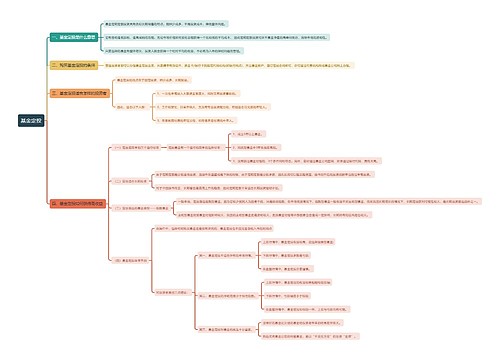

树图思维导图提供 关于水岸春城地面停放车辆的分阶段分区管控方案 在线思维导图免费制作,点击“编辑”按钮,可对 关于水岸春城地面停放车辆的分阶段分区管控方案 进行在线思维导图编辑,本思维导图属于思维导图模板主题,文件编号是:b7cacbcb60cd785d3e836665ab120d6d

上海工商

上海工商