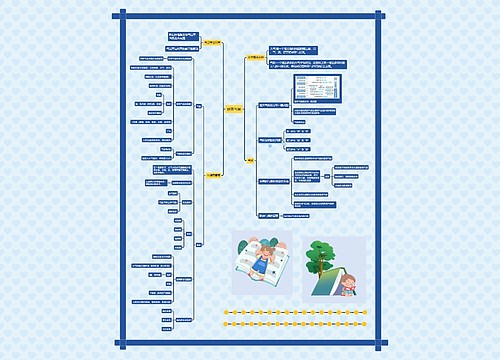

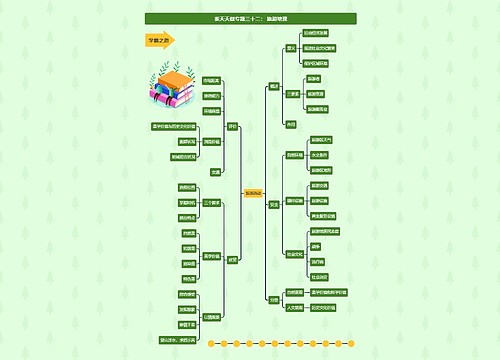

Business law思维导图

Business law

树图思维导图提供 Business law 在线思维导图免费制作,点击“编辑”按钮,可对 Business law 进行在线思维导图编辑,本思维导图属于思维导图模板主题,文件编号是:165299dc6aeae823e680cbcd7807b74f

思维导图大纲

Business law思维导图模板大纲

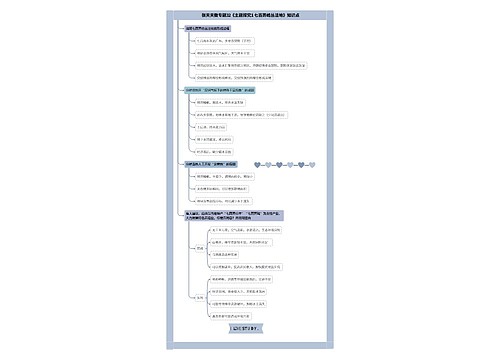

partnership

requirement

two or more persons, including company

carry on business on common (run business together)

intention to make profit

formality

no formality required, no need in writing

contribution not required

not limit on number of partners

receipt of share of profit is prima facie evidence

exclusion: repayment of debt, remuneration of employee

agreement re loss is not adequate evidence

authority to bind firm

actual authority

express

implied

apparent (ostensible) authority

excpetion

person knew partner had no authority

person did not know or believe they are dealing with a partner

duty

fiduciary duty to each other

account for secret profit and competing business

disclose information affecting partnership

liability

jointly liable for partnership debts

creditor may pursue one or all of partners

incoming partner

liable for debts occurring after join

outgoing partner

still liable after retire until notice given to creditors (London Gazette), unless creditor do know existence of outgoing partner

holding out

a person not a partner but show others he is, so he give credit to partnership business, he is liable

property

partnership property or partner's property - depends on intention

individual partner's creditor cannot execution on partnership property, but can apply court order charging partner's interests in firm

profits

shared equally unless agreed otherwise

cannot distribute before dissolution unless agreed otherwise

partner can assign rights to profit to others (only profit, not liability)

loss

same as profit proportion

operation

keep its books at place of business

partner may loan to partnership at 5%

no remuneration unless agreed

unanimous agreed issues

adding new partner

change in nature of partnership

alter partnership agreement

expel existing partner (unless agreed otherwise)

termination

if no fixed term, any partner may dissolve by notice

dissolution by bankruptcy, death

if a partner charge his share for personal debt, other partner may dissolve

by court order

a partner become permanent incapacity

a partners prejudicial conduct affecting business

willful or persistent breach of agreement

business can be carried on only at a loss

just and equitable reason

distribution

1. debt; 2. loan; 3. contribution; 3. profit

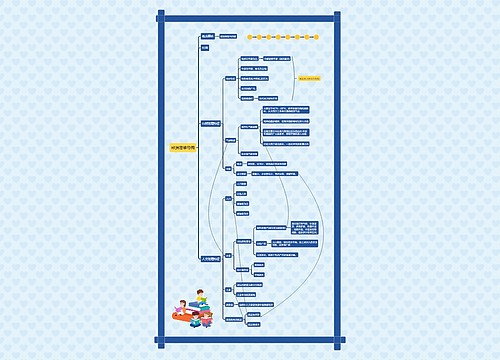

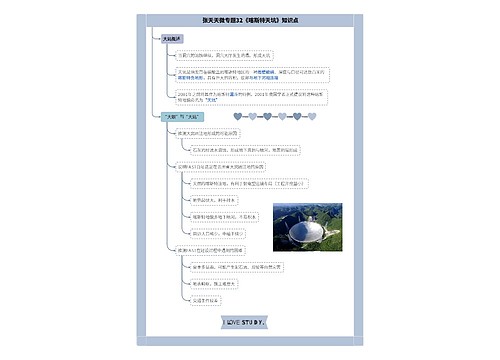

LLP

partnership like

individual income tax

partner cannot transfer ownership without unanimous consent

managed by partners

add new member need unanimous consent

company like

floating charge

register requirement

obtain certificate of incorporation before run business

unique name and company number

annual accounts

annual confirmation statement

details of appoint and remove member or information change of member

notice change of member within 14 days

people with significant control

need to register

directly or indirectly holds more than 25% of surplus assets on winding up;

more than 25% of rights to vote

rights to appoint or remove majority in management

significant influence or contract

termination

clawback provision

member withdraw property within 2 year before LLP go into insolvent and had reasonable ground know so, court may order member contribute the property

majority of member may apply for LLP to struck out

exception

doing business or change name in last 3 months

in insolvency proceedings

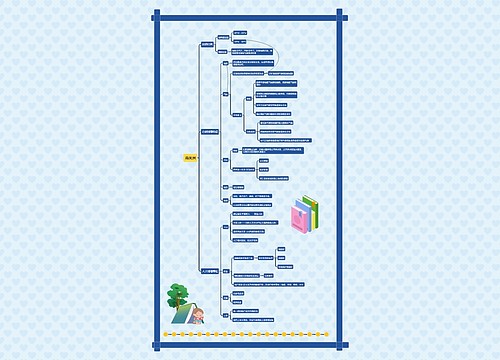

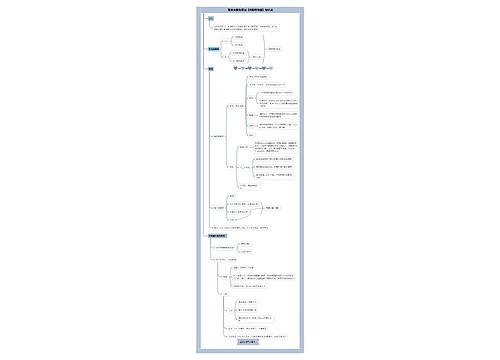

company

types

unlimited company

no need to publish accounts

limited by guarantee

non-profit organisation

public limited - PLCs

minimum 50,000, and a trading certificate

formation

promoter owe fiduciary duty to company - act in good faith

memorandum of association

signed by subscribers. need to submit to registrar

pre-corporation contracts

promoter personally liable even after company is formed

shelf companies

quick setup: change only members

register

change company name: provide a copy of resolution

constitution

article of association and resolution or agreement to amend it

contract between member and company

veil of incorporation

lifting event

fraud or avoid existing obligations

director and officers

type

de jure

de facto: not formally appointed

shadow: regularly influence acts of directors

alternate

nominee

represent particular sharehold

duty

insolvency

duty to shareholder replace by to creditor

casting vote

chairman have a casting vote in event of deadlock

written resolution

no need meeting but need unanimous approval

disqualification

2-15 years for unfitness

company secretary

appoint by directors

audit

turnover less 10 million and no more than 50 employees not need

special resolution 75% or more

entrenchment: require more onerous process to for alter articles

amendment adverse to minority is not sufficient grounds if it is made in good faith in company interest

ordinary resolution more than 50%

appoint or remove director

Bushell v Faith Clause director is also a shareholder, have right to vote

substantial property transaction

more then 100,000 or 10% of net assets

preemption rights

new share first offer to existing shareholders,

not apply if consideration is not cash

not apply to preference share

maybe disapplied by special resolution

transfer of share

private company governed by articles. model article give director right to refuse transfer

charge

must registered within 21 days

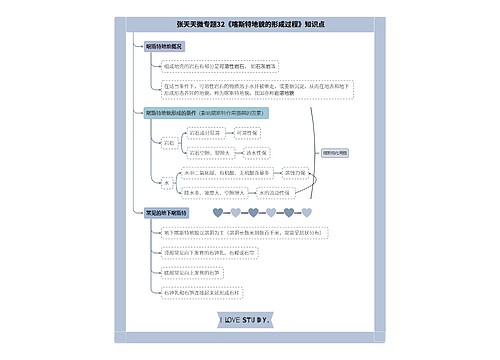

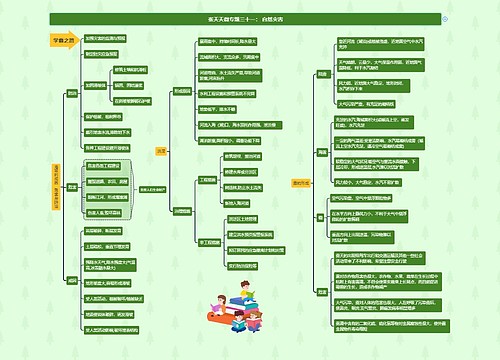

insolvency

individual voluntary arrangement

bankruptcy debt more than 5,000

debtor will be discharged after one year

official receiver acts as trustee

company insolvency

receivership

fixed asset receivership

receiver possess assets securing loan

restructuring plan

75% unsecured debt agreed

moratorium

prevent creditor from taking action

administration and company voluntary arrangement

liquidation

sequences

expenses of winding up

preferential debt

secured by floating charge

unsecured debt

clawback

preference

within 6 months

within 2 years with connected person

intentional

undervalue

company

2 years -

been insolvent or become so as a result

if connected person, assume in insolvent

individual

5 years -

2 years no need insolvency

if connected person, assume in insolvent

defence

good faith

ring fencing

liquidator should set aside part of floating charge to benefit unsecured creditor

50% of 10,000

20%- above 10,000, max 800,000

相关思维导图模板

树图思维导图提供 Business Meeting思维脑图 在线思维导图免费制作,点击“编辑”按钮,可对 Business Meeting思维脑图 进行在线思维导图编辑,本思维导图属于思维导图模板主题,文件编号是:ccd82728603dbb40ed7390026826678d

树图思维导图提供 Commerce (Business) 在线思维导图免费制作,点击“编辑”按钮,可对 Commerce (Business) 进行在线思维导图编辑,本思维导图属于思维导图模板主题,文件编号是:a70b9cff06b5b39925f00d8f6b43d45a

上海工商

上海工商