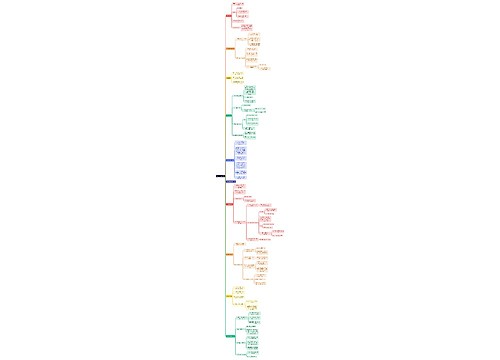

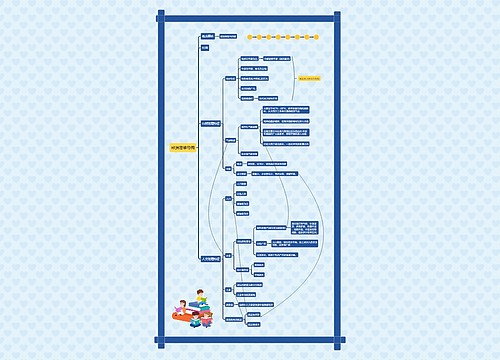

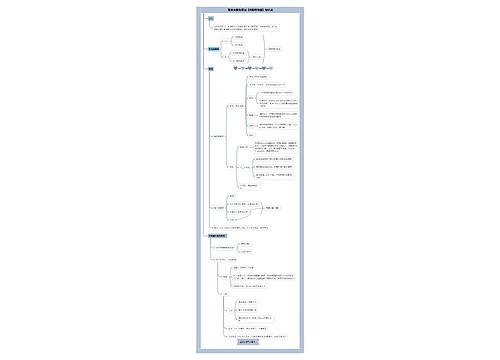

Tax law-general思维导图

Tax law-general

树图思维导图提供 Tax law-general 在线思维导图免费制作,点击“编辑”按钮,可对 Tax law-general 进行在线思维导图编辑,本思维导图属于思维导图模板主题,文件编号是:5da6dc9555a9d037b809f3c106edcfd1

思维导图大纲

Tax law-general思维导图模板大纲

Income Tax

Non-saving income

Saving income

Dividend income

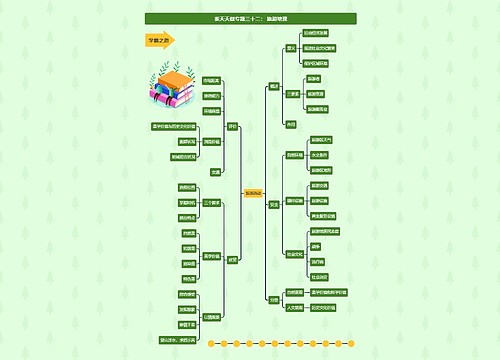

Capital Gains Tax-CGT

chargeable capital asset

exempt assets

cash

wasting chattels

non-wasting assets less than GBP6000

passenger car

reliefs

Inheritance Tax-IHT

chargeable lifetime transfers - CLTs

gifts to trusts

gifts to a company

potentially exempt transfers -PETs

exempt transfers

gifts to spouses

small gifts up to 250/person

gifts on marriage

normal expenditures (Christmas gifts)

gifts within annual exemption of 3000

Corporation Tax

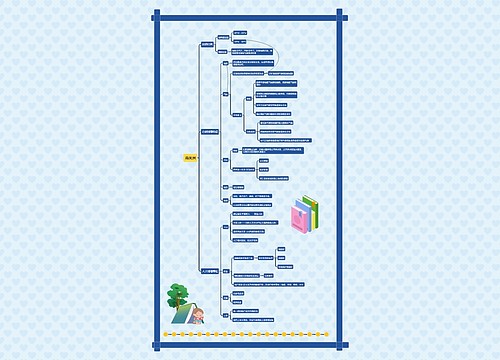

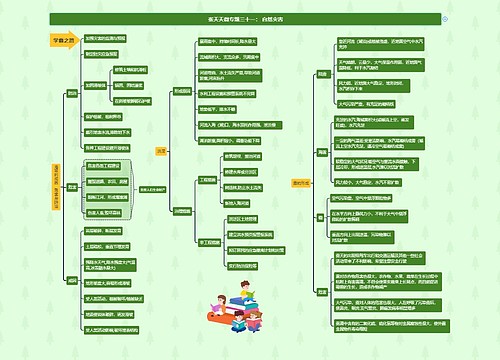

Value Added Tax - VAT

rate

20%

5%: domestic fuel, installation of energy-saving material, child car seat

0%: food, books, newspapers, water and sewerage service, transport, residential construction

exempted: land, insurance, financial service, education, health, postal

excluded: sale of company share, sale of business as a going concern

registration

standard

threshold: 85,000

historic test: preceding 12 months on a rolling basis

future test: next 30 days alone

voluntary registration

if registered, must charge VAT to all customers

if supply only exempt items, cannot register

cancelling registration

if taxable turnover falls below 83,00 for a 12-month period

obliged to deregister if stop trading

option to tax

sale or lease land may opt to charge VAT

20% rate apply

may choose individual land or building, not all land and building owned by tax payer

not apply to residential land and building

revocation of option

can revoke within 6 months if not been put in practice

otherwise after 20 years with consent of HMRC

accounting

account for VAT 1 month after each VAT quarter

tax point

basic tax point: time of supply

issue VAT or receive payment in advance;

issue VAT within 14 days after basic tax point

Stamp Duty Land Tax - SDLT

buyer paid SDLT within 14 days of completion

lease: tax on lease premium and net present value of rant

mortgage deducted or not?

threshold and rate

tiered tax depending on total amount and whether residential or non-residential

tax on net present value of rent is lower

property given to company in exchange of share: company need send SDLT return and pay SDLT

exemption

property transferred as gift - subject to IHT

to spouse/former spouse when divorce

under a variation of a will (change beneficiary) within 2 years of death

relief

first residence

apply only if under 500,000. if exceed 500,000, not applicable at all

0% for 0-300,000

5% for 300.000-500,000

additional charge for additional residential

additional 3% in each band

not apply to transaction under 40,000

not apply (or refundable) in case of replacement

linked transaction

taxable amount: average amount

six or more residential properties: apply non-residential rate

相关思维导图模板

树图思维导图提供 Tax 1- Income Tax 在线思维导图免费制作,点击“编辑”按钮,可对 Tax 1- Income Tax 进行在线思维导图编辑,本思维导图属于思维导图模板主题,文件编号是:2ddc786d7b13a61ca86257e8c565a01e

树图思维导图提供 湛江市税务局12月15日V-Tax远程可视化办税培训时间安排 在线思维导图免费制作,点击“编辑”按钮,可对 湛江市税务局12月15日V-Tax远程可视化办税培训时间安排 进行在线思维导图编辑,本思维导图属于思维导图模板主题,文件编号是:f7d5eabfb3181db1bcbdff087dcb7071

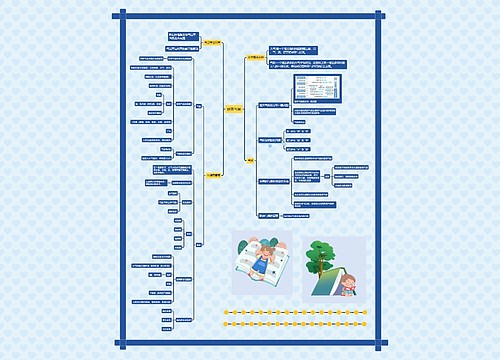

上海工商

上海工商