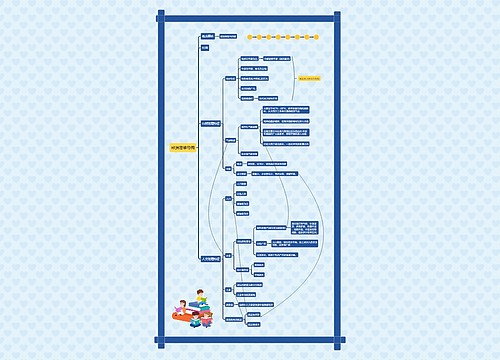

Tax 1- Income Tax思维导图

Tax 1- Income Tax

树图思维导图提供 Tax 1- Income Tax 在线思维导图免费制作,点击“编辑”按钮,可对 Tax 1- Income Tax 进行在线思维导图编辑,本思维导图属于思维导图模板主题,文件编号是:2ddc786d7b13a61ca86257e8c565a01e

思维导图大纲

Tax 1- Income Tax思维导图模板大纲

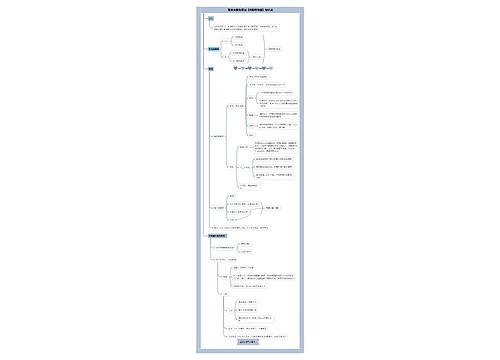

basic info

nature: recurring basis, not one-off

payee

individuals

PRs on behalf of deceased

trustee on behalf of trust

tax year: 6 April to 5 April

anti-avoidance

double reasonableness test-cannot reasonably be regarded as a reasonable course of action

collection system

1-Pay As You Earn - PAYE

Full Payment Submission - FPS

submit monthly or quarterly (if less than 1500 per month)

late report and payment: interests and penalty

2-Self-Assessment

submit annual tax returns online

1st payment: due on 31 January in tax year -50%

2nd payment: due on 31 July after tax year -50%

late file or late payment-penalty

30% of tax loss

up to 100%for deliberate

tax band

basic rate band - 20% - from 1 to 37,700

higher rate band - 40% from 37,700 - 150,000

additional rate band - 45% - over 150,000

categories

1-non-saving income

1-earnings and pensions:salary, bonus, non-cash benefits(car, private medical insurance), state pension, job-seeker allowance

2-trading income

3-property income - rental income

2-saving income

taxed on tax band

personal saving allowance - PSA

basic rate band - 1000

higher rate band - 500

3-dividend income

rate

basic rate band - 7.5%

higher rate band - 32.5%

additional rate band - 38.1%

Dividend allowance - 2000 for all bands

note: foreign income

UK resident should pay tax on foreign income

183 days in UK during tax year

exempt income

1. interest from National Savings Certificate

2. Individual Savings Account: ISA, up tp 20000 per year: 4 types: case, stocks and shares, innovative finance, lifetime ISAs

3. Premium Bonds, betting, gaming, lotteries

4. social security benefits - universal credit, housing credit, winter fuel allowances for pensioners

5. child benefit - exception: high-income child benefit charge

6. child tax credit, working tax credit

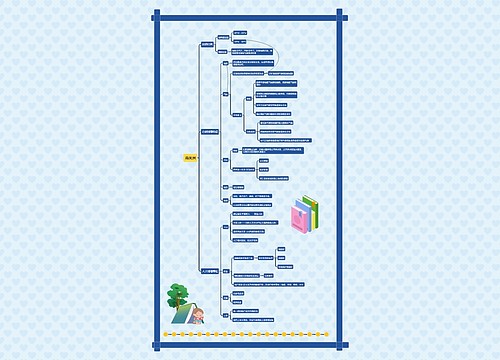

Non-Saving Income

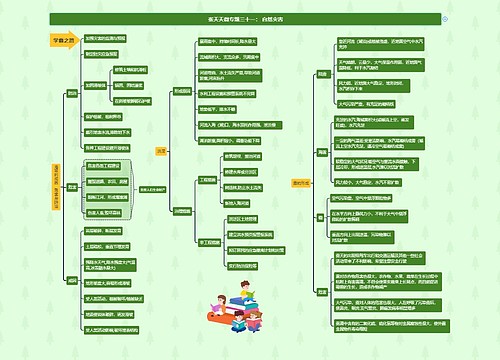

trading profit

register within 3 months starting business

accounting period - 12 month chosen by taxpayer

business expenses

revenue related

only proportion for business purposes

capital expenses (one-off item)

annual investment allowance - AIA

plant and machinery - up to 1,000,000

writing down allowance

apply to

plant and machinery exceeds 1,000,00

car, land, building

method: deduct fixed percentage of current tax value (reduce every year) yearly

rate

6% for long-life assets

18% for most assets

pool: put all asset together

main/standard pool -18%

special rate pool - 6%

structures and building allowance

building and structures

trading losses

only apply to sole trader or partner

four alternatives

1. current year/prior year loss relief

set off total income

if loss remains, may set off capital gains (saving CGT)

2. carry forward of loss relief

set off future profit of the same trade

3. carry forward relief on incorporation of business

transfer business to company and receive share in return

set off any unused trading losses against salary or dividend for any years

4. terminal loss relief

current tax year and 3 preceding year

Last in, First Out - LIFO

set off only profits of trade, no other income

partnership

file partnership tax return annually

salary and interest deducted first

payable even if retain profit in business

overlap profit problem -

only in first accounting period

not refund until trade ceases, or sole trader change accounting date to 5 April

income allowance

interests of qualifying loan - used for

capital contributions or loan to partnership

investment in a close trading company

payment of inheritance tax for PRs

personal allowance

12,570 for 2021/22

tapered by 1 for every 2 of income above 100,000, if exceeding 125,140, no allowance

marriage allowance

actually married or in a civil relationship

transferring spouse's income must less than personal allowance

recipient spouse must be basic rate taxpayer

additional allowance

income from personal saving

receipt of dividends

相关思维导图模板

树图思维导图提供 Tax law-general 在线思维导图免费制作,点击“编辑”按钮,可对 Tax law-general 进行在线思维导图编辑,本思维导图属于思维导图模板主题,文件编号是:5da6dc9555a9d037b809f3c106edcfd1

树图思维导图提供 英语四级考前辅导:5个语法误区1-不能以介词结尾 在线思维导图免费制作,点击“编辑”按钮,可对 英语四级考前辅导:5个语法误区1-不能以介词结尾 进行在线思维导图编辑,本思维导图属于思维导图模板主题,文件编号是:95a24a11a3a71a77feacd37c3601f4cc

上海工商

上海工商